The History of Bitcoin

Cryptocurrencies are digital currencies utilizing cryptography, ensuring data is unreadable without a password. This makes them nearly impossible to forge, although their security relies on various factors. Modern cryptocurrencies operate on decentralized systems using blockchain technology, initially detailed by cryptographer David Chaum in 1982.

The blockchain acts as a public ledger of encrypted transactions, updated by many globally. While Bitcoin isn't the first digital currency or the first to use blockchain and public key cryptography, it uniquely combines these components, making it the first modern cryptocurrency. Let’s explore the history of cryptocurrency.

Before Bitcoin

2000's

Before the creation of Bitcoin, there were quite a few examples of online digital currencies, but none succeeded in attracting much interest or establishing themselves in financial markets.

Two examples of such currencies are B-Money and Bit Gold.

Satoshi Nakamoto and Bitcoin

2008

The internet domain bitcoin.org was registered in August 2008. It remains the homepage of the world’s most widely used cryptocurrency. On October 31 of the same year, a person or organization using the name Satoshi Nakamoto published a scientific paper titled Bitcoin: A Peer-to-Peer Electronic Cash System. This paper is known in the crypto world as “Satoshi’s whitepaper.”

The paper presented the concept of cryptographically secured blockchain technology. Bitcoin was described as a theoretical open-source digital resource. “Open source” meant that no one owned it and that everyone could participate in its use and development.

To this day, no one knows who Satoshi Nakamoto is. His identity is subject to lots of myths and theories. It is possible that his identity will always remain unknown.

Bitcoin Mining Begins

2009

In early 2009 the Bitcoin software became available to the public for the first time. Satoshi Nakamoto mined the first 50 Bitcoins, thus launching the practice of crypto mining. It was a time when only a small team of programmers and enthusiasts participated in the development of what few of them anticipated would one day be viewed as a groundbreaking technology.

Early Transactions

2010

It wasn’t realistic to attribute any real value to Bitcoin during its first year of existence. Developer Gavin Andresen bought 10,000 Bitcoins for $50 and created a website called Bitcoin Faucet where he literally donated Bitcoin for fun.

The most famous tale from this era concerns Laszlo Hanyecz, a software developer who bought two pizzas for 10,000 Bitcoins. This is widely recognized as the very first cryptocurrency transaction. At Bitcoin’s peak price, those two pizzas would be worth well in excess of $600 million. But Laszlo never regretted his decision. He believes it was a crucial step in establishing the growth of the crypto ecosystem.

In December 2010, Satoshi Nakamoto posted his last public message to the popular online forum called bitcointalk. He wrote about some minor details about the latest version of the software. Afterwards, he remained in touch with some programmers via email, but there is no trace of him after April 2011.

New Cryptocurrencies Are Born

2011

On the wing’s of Bitcoin’s success, the idea of decentralized digital currencies slowly started to gain traction. As a result, the first alternative cryptocurrencies began to appear. Because these currencies were alternatives to the established cryptocurrency, Bitcoin, they were known as altcoins.

Most altcoins offer incremental improvements over the original Bitcoin protocol, features like greater speed, enhanced anonymity, and so on. Litecoin was among the first altcoins, which is why it is sometimes portrayed as the silver to Bitcoin’s gold. There are now thousands of cryptocurrencies.

The First Big Bubble

2013

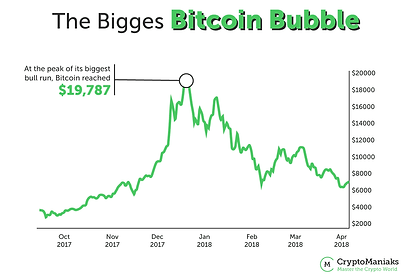

In January 2013, the price of a single Bitcoin exceeded $1,000 for the first time. It was an important milestone, even if the price dropped quickly afterward and then stagnated for about two years before managing to hit the $1,000 mark again.

Some early adopters suffered great losses during the price lull, and it caused a lot of negative press for Bitcoin. There was a lot of news coverage, and many people learned about cryptocurrency for the first time in the context of these lost fortunes.

The crypto market grew slowly. It wasn’t clear how many of the alt coins would survive. Many didn’t.

Mt. Gox and Turbulent Times

2014

The market’s biggest cryptocurrency exchange was a website called Mt. Gox. In January 2014, it was hacked. The hackers got away with 850,000 bitcoins. It still isn’t clear who was responsible for what remains the largest theft in crypto history.

Critics said that because cryptocurrencies are based on anonymity and decentralization, it was no wonder it was hacked and that the hackers were impossible to trace.

In November 2014, the founder of the Silk Road crypto website was sentenced to life imprisonment after illegal drugs were found to account for about 70% of the products sold via his website, which relied on Bitcoin to make sales to anonymous customers.

Ethereum and the Altcoin Boom

2015

The Ethereum project was launched in 2015. Some people think of it as the first truly useful implementation of the ideas underlying Bitcoin.

Ethereum introduced smart contracts, a technology that allows the blockchain to host software programs in addition to crypto funds. Smart contracts enabled the development of complex, useful applications in finance and other areas.

A Flood of ICOs

2016

Ethereum’s popularity was marked by the emergence of projects that acquired start-up funds via crowdfunding – specifically initial coin offerings in which new tokens are offered to investors much as newly issued stock is offered to investors when a corporation goes public in an IPO, or initial public offering. People bought the coins as investments or to support the projects the coins were created to support.

Some of the ICOs turned out to be poorly conceived. Some were get-rich schemes. Some were Ponzi schemes masquerading as legitimate investments. And some laid the groundwork for innovative, useful products and services.

Bitcoin reaches $20,000

2017

The number of publicly available trading platforms and exchanges gradually increased, making it much easier to buy and sell cryptocurrencies. The explosion of ICOs intensified.

All of this contributed to the rapid growth of the ecosystem. This young technology promised huge profits, and the total market capitalization of cryptocurrencies exceeded $800 billion dollars by the start of 2018. It seemed like the only thing you needed to put a new company on the map was to make sure “crypto” or “blockchain” was part of its name.

El Salvador adopts Bitcoin as Legal Tender

2021

El Salvador became the first country to adopt Bitcoin as legal tender, alongside the U.S. dollar. This initiative aimed to enhance financial inclusion and facilitate remittances. However, the policy faced challenges, including public skepticism and technical issues with the government’s digital wallet, Chivo. Despite these hurdles, President Nayib Bukele’s administration continued to promote Bitcoin adoption.

FTX Collapse

2022

In November 2022, Bitcoin’s price plummeted below $16,000, reaching a two-year low following the sudden collapse of the cryptocurrency exchange FTX. Once one of the largest and most trusted platforms in the crypto industry, FTX filed for bankruptcy amid allegations of financial misconduct, including the misuse of customer funds.

This event sent shockwaves through the crypto market, wiping out billions of dollars in value and leading to a liquidity crisis across the industry. The collapse of FTX triggered a broader crisis of confidence, with many investors questioning the stability and transparency of centralized exchanges.

Recovery and Evolution

2023

2023 marked a year of resilience and innovation for Bitcoin, as the cryptocurrency began to recover from the tumultuous events of 2022 while introducing new developments that reshaped its ecosystem. Despite ongoing regulatory scrutiny, Bitcoin demonstrated its staying power and capacity for evolution.

Key Highlights:

-

Market Recovery:

-

Bitcoin’s price rebounded to $40,000 by mid-year, reflecting renewed investor confidence after the FTX collapse.

-

Institutional interest grew, with more companies integrating Bitcoin into their portfolios as a hedge against macroeconomic uncertainties.

-

-

Introduction of Bitcoin Ordinals:

-

he launch of Bitcoin Ordinals introduced non-fungible tokens (NFTs) to the Bitcoin blockchain, enabling digital artifacts to be inscribed directly onto the network.

-

This innovation expanded Bitcoin’s utility beyond its traditional role as a store of value and payment network, sparking debates about its broader potential.

-

-

Continued Adoption by El Salvador:

-

El Salvador doubled down on its Bitcoin strategy by promoting Volcano Bonds and launching projects to enhance Bitcoin mining operations using geothermal energy.

-

The country’s efforts underscored Bitcoin’s growing use as a tool for national economic development.

-

-

Regulatory Advancements:

-

The approval of additional Bitcoin futures ETFs in the United States facilitated broader institutional access to Bitcoin investments.

-

While regulatory uncertainty persisted, these advancements signaled increasing acceptance of Bitcoin within traditional financial markets.

-

-

Sustainability Debates:

-

Following Ethereum’s transition to proof-of-stake, Bitcoin faced renewed criticism over its energy-intensive proof-of-work system.

-

Discussions around Bitcoin mining sustainability gained momentum, with some miners adopting renewable energy sources to address environmental concerns.

-

Milestones and Maturity

2024

2024 marked a pivotal year for Bitcoin as it achieved new milestones, expanded its ecosystem, and continued its journey toward mainstream adoption.

Key Highlights:

-

Bitcoin Surpasses $100,000:

-

In December, Bitcoin reached an all-time high of $103,000, driven by institutional investments and favorable regulatory developments.

-

-

Spot Bitcoin ETFs Approved:

-

The U.S. Securities and Exchange Commission (SEC) approved multiple spot Bitcoin ETFs, allowing investors direct exposure to Bitcoin via traditional financial markets.

-

Major firms like BlackRock and Fidelity launched funds, fueling market optimism.

-

-

Fourth Bitcoin Halving:

-

The halving in April 2024 reduced block rewards from 6.25 BTC to 3.125 BTC, impacting supply dynamics and reinforcing Bitcoin’s scarcity narrative.

-

-

Launch of Taparoo Swap:

-

The first decentralized exchange on Bitcoin’s Layer 1 enhanced Bitcoin’s role in decentralized finance (DeFi), attracting new users and developers.

-

-

Increased Focus on Sustainability:

-

Bitcoin mining saw greater adoption of renewable energy sources as the industry addressed environmental concerns.

-

Innovations in mining technology aimed to reduce carbon footprints.

-

-

El Salvador’s Bitcoin City:

-

Progress on the Bitcoin City project, powered by geothermal energy, highlighted Bitcoin’s potential for national infrastructure development.

-

The Future of Bitcoin

Could this be the year Bitcoin proves itself? What does the Bitcoin history timeline hold from here on out?

The U.S. Government is printing over $2 trillion of stimulus money to inject into the economy as quickly as possible.

Not to mention the billions that other countries are printing.

Could that money find its way into Bitcoin and other cryptocurrencies?

Could this be the decade Bitcoin shows the world how powerful a decentralized, global, cryptocurrency will be?

The future will tell us.

Which date do you think is most important? What will be the next important date for Bitcoin?